Teleological Equivalence of The Treachery of Images and Facts and Circumstances in Legal Analysis

I recently had a fascinating epiphany while studying surrealist art during my last visit to the High Museum of Art in Atlanta. An art museum was undoubtedly a most unlikely venue for the sort of realization I had as it was one which led me to consciously understand something about legal analysis, a considerable preoccupation of mine due to my profession as an international tax practitioner, that I hitherto only intuited: the conceit of many legal/tax practitioners to classify claims as facts and circumstances, particularly in the rendition of certain forms of written advice.

In the formulation of advice, practitioners invariably initially engage in a fact-finding exercise whereby they raise empirical questions to understand their client’s facts and circumstances. Once the relevant facts and circumstances are ascertained, the practitioner must judge how the law applies thereon. Any conclusion or advice necessarily proceeds therefrom. In legal analysis, gathering the complete set of the relevant facts is critical as the slightest omission, extraneous addition, or misunderstanding of a factual matter can change the applicable laws thereby leading to an erroneous conclusion. Enter surrealism.

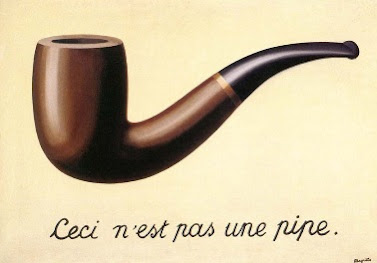

René Magritte, the famous Belgian surrealist painter, produced

an intriguing oil painting titled The Treachery

of Images. The work is nothing more than an image of a pipe anti-humorously

captioned “Ceci n’est pas une pipe”

which is French for “This is not a pipe.”

“The famous pipe. How

people reproach me for it. And yet, could you stuff my pipe? No, it’s just a

representation, is it not? So if I had written on my picture “This is a pipe,” I’d

have been lying!”

–René Magritte

Comments

Post a Comment